Tax Rate In California 2025

Tax Rate In California 2025. As described earlier, collections data to date show a severe revenue decline, with total income tax collections down 25 percent in 2022‑23. The 2024 tax rates and thresholds for both the california state tax tables and federal tax tables are comprehensively integrated into the california tax calculator for 2024.

How are california tax brackets determined? Quickly figure your 2023 tax by entering your filing status and income.

Your Tax Rate And Tax Bracket Depend On Your Taxable.

If you have questions on income tax.

Its Base Sales Tax Rate Of 6.00% Is Higher Than That Of Any Other State, And Its Top Marginal Income Tax Rate Of.

This page has the latest california brackets and tax rates, plus a california income tax calculator.

Tax Rate In California 2025 Images References :

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T200018 Baseline Distribution of and Federal Taxes, All Tax, The government also approved on thursday a cut in the normal corporate income tax rate to 15% by 2027 from 21% currently and a new mandatory minimum tax. California has nine state income tax rates, ranging from 1% to 12.3%.

Source: taxfoundation.org

Source: taxfoundation.org

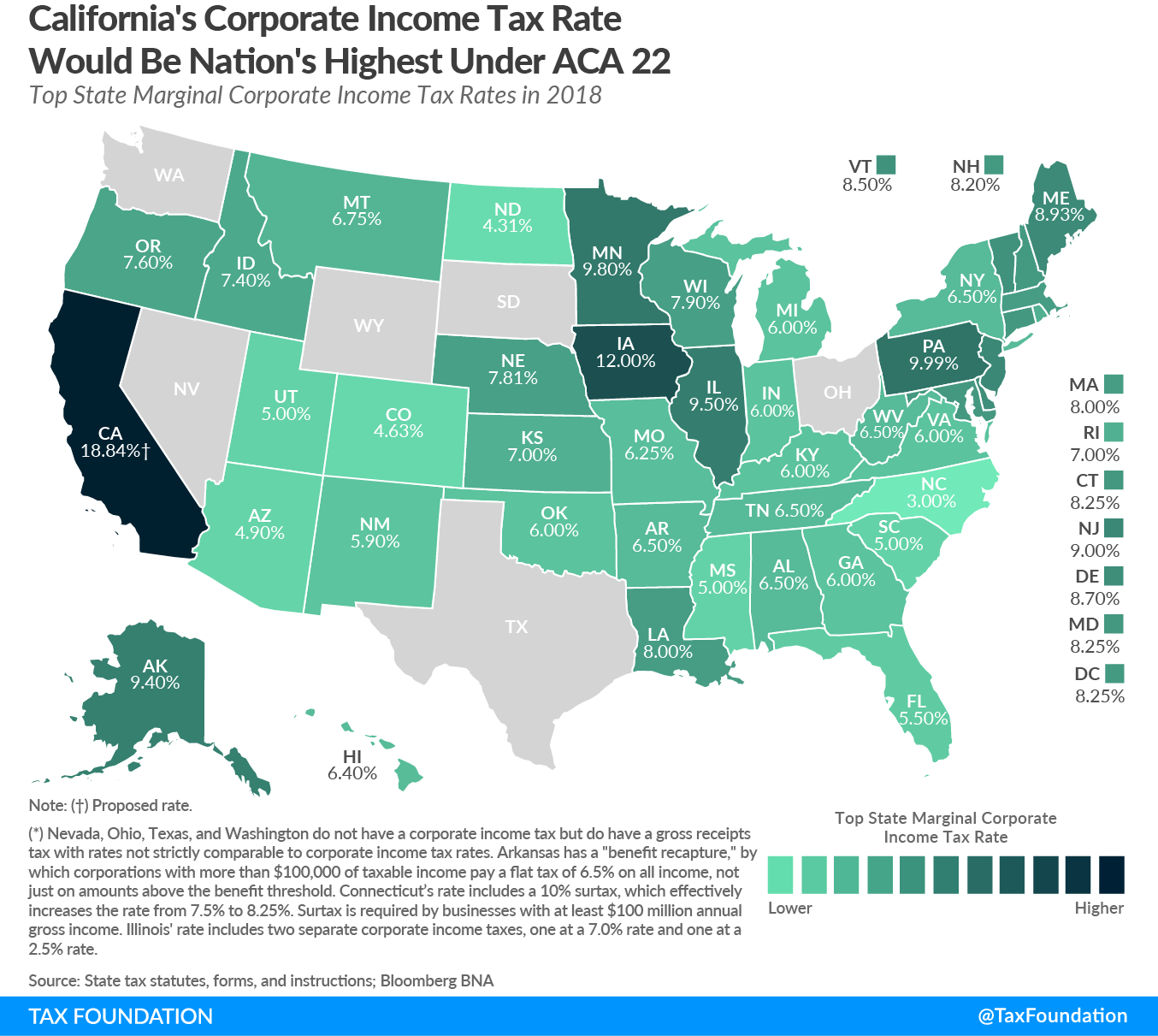

California’s Corporate Tax Rate Could Rival the Federal Rate, On a gross basis, we estimate biden’s fy 2025 budget would increase taxes by about $4.4 trillion over that period. The 14.4% rate is a combination of the highest marginal tax bracket, mental health tax and now uncapped state disability insurance, which is a payroll tax.

Source: calbudgetcenter.org

Source: calbudgetcenter.org

California and Federal Dollars A TwoWay Street California Budget, How are california tax brackets determined? Quickly figure your 2023 tax by entering your filing status and income.

![California State Tax Expenditures Total Around 55 Billion [EconTax Blog] California State Tax Expenditures Total Around 55 Billion [EconTax Blog]](https://lao.ca.gov/Blog/Media/Image/148) Source: lao.ca.gov

Source: lao.ca.gov

California State Tax Expenditures Total Around 55 Billion [EconTax Blog], If you have questions on income tax. Do not use the calculator for 540 2ez or prior tax years.

Source: susiqlurline.pages.dev

Source: susiqlurline.pages.dev

California State Tax Brackets 2024 Donia Garland, If you have questions on income tax. Your tax rate and tax bracket depend on your taxable.

Source: www.cheukying.com

Source: www.cheukying.com

美国各州企业所得税、个人所得税和消费税税率对比_卓盈企业管理有限公司, California also has a 7.25 percent state sales tax rate and an average combined state and local sales tax rate of 8.85. If you have questions on income tax.

Source: winnahwdona.pages.dev

Source: winnahwdona.pages.dev

Pay Rate In California 2024 Marie Selinda, The 14.4% rate is a combination of the highest marginal tax bracket, mental health tax and now uncapped state disability insurance, which is a payroll tax. Its base sales tax rate of 6.00% is higher than that of any other state, and its top marginal income tax rate of.

Source: worksheetmediavogt.z19.web.core.windows.net

Source: worksheetmediavogt.z19.web.core.windows.net

California Tax Calculator With Dependents, 1, 2025, entity affiliates of retailers can no longer take any california deduction related to bad debt or refunds of sales tax. If you have questions on income tax.

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T220078 Average Effective Federal Tax Rates All Tax Units, By, Find your local tax rate ,. California state tax rates and rules for income, sales, property, fuel, cigarette and other taxes that impact residents.

Source: calbudgetcenter.org

Source: calbudgetcenter.org

California's Tax & Revenue System Isn't Fair for All California, This page has the latest california brackets and tax rates, plus a california income tax calculator. How are california tax brackets determined?

California State Tax Rates And Rules For Income, Sales, Property, Fuel, Cigarette And Other Taxes That Impact Residents.

Its base sales tax rate of 6.00% is higher than that of any other state, and its top marginal income tax rate of.

Find Your Local Tax Rate ,.

Calculate your income tax, social security.

Category: 2025